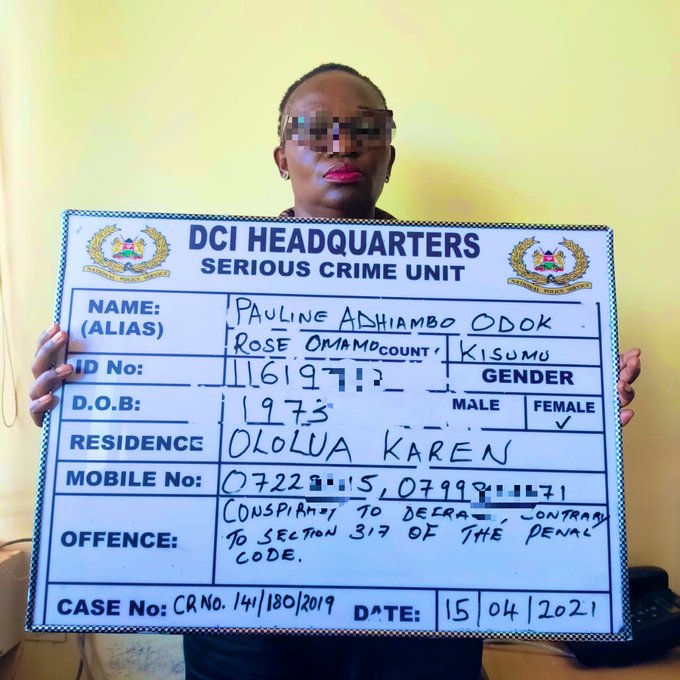

In a major breakthrough against high-value financial crime, detectives have arrested Pauline Adhiambo Odok, also known as Rose Omamo, over an alleged Sh300 million fake gold scam that targeted a foreign investor.

Pauline was arrested at Ololua, Dam Estate, after months on the run, bringing to a close one of Kenya’s most elaborate gold fraud cases in recent years—one that has reignited debate over fraud, weak oversight, and trust in the gold trade.

How the Sh300 Million Fake Gold Scam Was Orchestrated

Fake Identity and High-Level Deception

Investigators say Pauline masterminded the scheme by masquerading as a relative of a senior government official, a calculated move designed to project influence, legitimacy, and access to restricted resources.

This false identity enabled her to gain the confidence of foreign investors seeking entry into Kenya’s gold trade—an industry that has increasingly attracted fraudsters exploiting regulatory loopholes.

The Victim: Foreign Investor Drawn Into the Trap

The primary victim was Southorn Chanthavong, a director at Simong Group Company, based in Laos.

Chanthavong was lured by promises of access to large quantities of gold and was assured that the transaction was secure, legitimate, and backed by powerful connections.

Inside the Fake Gold Deal

Meetings in Nairobi’s Upscale Neighbourhoods

Between May 8 and May 25, 2019, Pauline and her accomplices held multiple meetings with the victim at Kaputei Gardens in Kileleshwa, a high-end Nairobi neighbourhood chosen to reinforce the illusion of credibility.

Display of “Gold Bars”

During the meetings, Chanthavong was shown what appeared to be genuine gold bars, neatly packed in heavy metal boxes. The presentation was convincing enough to dispel doubts and push the deal forward.

Believing the gold was authentic, the investor released Sh300 million, with the understanding that the consignment would be shipped to Laos.

Fraud Discovered After Gold Never Arrived

Days turned into weeks—but the promised gold shipment never arrived.

It soon became clear that the entire transaction was a carefully staged fraud, prompting Chanthavong to report the matter to Kenyan authorities.

The case was taken up by the Directorate of Criminal Investigations (DCI), which launched a full-scale probe into the scam.

Manhunt and Arrest at Ololua

Pauline Goes Underground

Following the complaint, a warrant of arrest was issued in January 2020, but Pauline disappeared, evading detectives for months.

The DCI issued public alerts and circulated her details nationwide, appealing to members of the public for information.

Breakthrough From the Public

The breakthrough came when a member of the public identified Pauline and tipped off investigators, leading to her arrest at Ololua, Dam Estate, without resistance.

Charges and Legal Consequences

Pauline now faces charges of conspiracy to defraud, while her accomplices—who were arrested earlier—are already before court.

If convicted, the suspects risk lengthy prison sentences, fines, and forfeiture of proceeds linked to the fraud.

Legal experts say the case could become a landmark precedent in tackling fake gold scams and protecting foreign investors.

Wider Impact on Kenya’s Gold Trade

Investor Confidence at Risk

The Sh300 million scam has deepened concerns among foreign investors, many of whom already view Kenya’s gold sector as high-risk due to recurring fraud cases.

Such incidents undermine confidence, discourage legitimate investment, and tarnish the country’s reputation.

Calls for Stronger Oversight

The case has renewed calls for:

-

Stricter regulation of the gold trade

-

Mandatory verification of sellers and intermediaries

-

Enhanced due diligence for foreign investors

Authorities say enforcement alone is not enough—systemic reforms are needed to seal gaps exploited by fraudsters.

A Warning to Fraudsters

The arrest of Pauline Adhiambo Odok sends a clear signal that economic crimes—even those involving complex deception and foreign victims—will eventually catch up with perpetrators.

Investigators credit public cooperation as a key factor in cracking the case, urging Kenyans to continue reporting suspicious activity.

As Pauline prepares to face justice, the case stands as both a cautionary tale for investors and a reminder that vigilance remains the strongest defence against fraud.