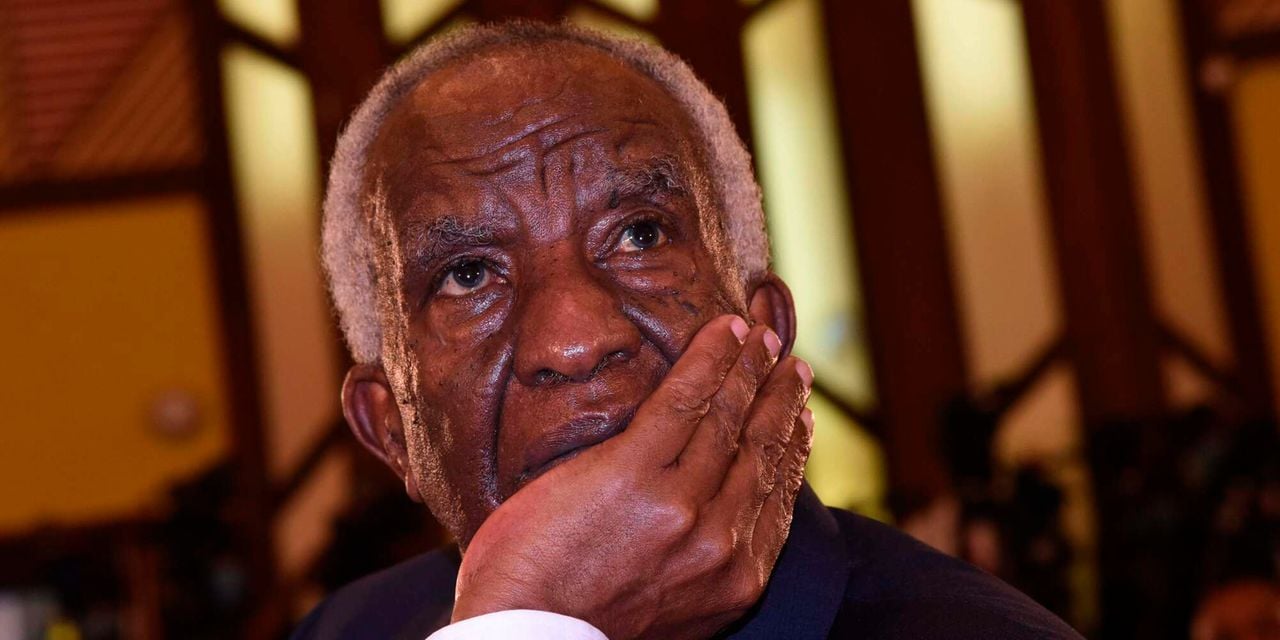

Peter Munga

The escalating financial troubles of billionaire businessman Peter Munga, the co-founder of Equity Bank, have taken a dramatic turn after his wife filed a fresh legal challenge against ABC Bank to stop the auction of 75 million Britam shares valued at Sh604 million.

This comes only days after the High Court dismissed Munga’s application to block the auction, ruling that the bank could proceed with the sale to recover a defaulted loan of Sh433.76 million.

Court Rejects Munga’s Injunction Bid

Justice Alfred Mabeya of the Commercial Division dismissed Munga’s plea for a permanent injunction, stating that the businessman had not presented sufficient legal grounds to restrain ABC Bank from exercising its rights as a secured creditor.

With that ruling, the bank received the go-ahead to dispose of the businessman’s shares in Britam Holdings Plc, a leading financial services group in which Munga is a significant shareholder.

Wife Steps In with New Suit

In a surprising twist, Munga’s wife has independently moved to court, naming ABC Bank, ABC Capital, and Equatorial Nut Processors as respondents.

Her petition argues that:

-

Matrimonial Property Rights Violated – The 75 million Britam shares were pledged as security without her consent, contrary to provisions of the Matrimonial Property Act.

-

Unlawful Dealings – Any attempt to transfer, charge, or auction the shares would amount to unlawful deprivation of matrimonial assets.

-

Compensation Claims – She is seeking damages for breach of statutory duty and constitutional rights, insisting that the bank’s move undermines her stake in family property.

She is asking the court for permanent orders restraining the bank from selling, transferring, or otherwise interfering with the shares until her rights are determined.

Legal Stakes and Banking Implications

The new case could delay ABC Bank’s efforts to recover the multimillion-shilling debt. Banking law experts say the case raises a critical precedent on whether lenders must obtain spousal consent before attaching securities that fall under matrimonial property.

“This dispute goes to the heart of how far banks can go when dealing with collateral that has dual ownership—both commercial and matrimonial,” explained a senior banking lawyer. “If the wife succeeds, it could force lenders to adopt stricter compliance checks when securing high-value assets.”

The case is also expected to attract close attention from financial institutions and corporate lawyers due to its potential ripple effect on secured lending practices in Kenya.

Munga’s History of Debt Challenges

This is not the first time the Equity Bank co-founder has faced debt-related court battles.

-

2017: He narrowly avoided the auction of five Nairobi properties worth Sh400 million by clearing arrears owed to Jamii Bora Bank.

-

2023: Three properties linked to him were lined up for auction to recover debts tied to Equatorial Nut Processors, a company associated with him.

Despite these financial hurdles, Munga remains a key figure in Kenya’s investment scene. His direct and indirect holdings in Britam Kenya Plc—through entities such as EH Venture Capital and EHL 2022—are estimated at Sh3.26 billion.

The Britam Shares at the Center of the Dispute

Britam Holdings Plc is one of Kenya’s largest financial services companies, offering insurance, asset management, and property investment. The 75 million shares under dispute represent a significant block, making the outcome of this case not just a personal matter for Munga, but also a potentially market-moving development.

Market analysts warn that a forced auction of such a large shareholding could affect Britam’s stock performance, depending on the buyer and the terms of the disposal.

Wider Economic Context

The dispute underscores the growing tension between borrowers and lenders in Kenya’s corporate sector, where high-value collateral is increasingly tied up in family ownership structures. It also raises important questions about:

-

Lender Rights vs Family Rights – How should courts balance the rights of financial institutions against the protections afforded to spouses under matrimonial law?

-

Corporate Governance Risks – When founders pledge significant shares in publicly listed companies as collateral, what safeguards should be in place to protect minority investors?

What Next?

The High Court’s dismissal of Munga’s injunction has cleared ABC Bank to proceed with the auction. However, the wife’s new petition could put the brakes on the sale, at least temporarily.

The case will now be heard in the coming weeks, with judges expected to decide whether ABC Bank acted within its rights or whether Munga’s wife has a legitimate matrimonial claim over the Britam shares.

Whichever way the ruling goes, this case is set to redefine the legal landscape for secured lending, matrimonial property rights, and corporate debt recovery in Kenya.