Documents and regulatory correspondence reviewed by CourtNews.co.ke have raised questions about a series of high-value banking transactions involving senior figures linked to KCB Group, former board members, and individuals associated with William Ruto.

The materials, whose authenticity could not be independently verified by this publication, are said to have formed part of regulatory queries handled by the Central Bank of Kenya (CBK) and relate to transactions flagged as unusual under banking and anti-money-laundering controls.

Retirement of Former KCB Director Raises Questions

In a notice to the Nairobi Securities Exchange, KCB Group previously announced the retirement of Adil Khawaja as a non-executive director.

Sources familiar with the matter allege that the departure followed internal concern arising from regulatory scrutiny of certain transactions. KCB has not publicly linked the retirement to any wrongdoing.

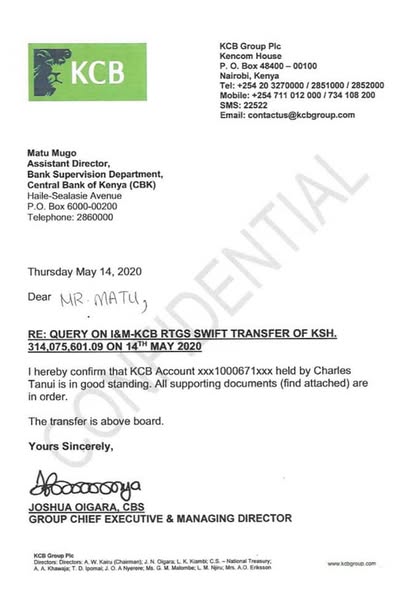

CBK Flagged Multi-Million Shilling Transfer

According to the documents reviewed, CBK flagged a KSh314 million transfer made in May 2020 from an account associated with Khawaja at I&M Bank to an account held by an individual identified as Mr Tanui, described in the documents as a relative of the Deputy President.

The same day, KSh240 million was reportedly withdrawn in cash from the recipient account. Banking records show the transaction was explained to the regulator as a tender-related payment linked to Kenya Pipeline Company (KPC).

The response to CBK’s query was reportedly approved by Joshua Oigara. Banking experts contacted by CourtNews.co.ke note that while senior approvals are not unlawful, regulators typically expect layered internal sign-offs for transactions of this magnitude.

CBK subsequently activated its anti-fraud unit, according to sources familiar with the inquiry.

Allegations of Coordinated Responses to Regulatory Queries

Investigative notes cited in the documents allege that responses to CBK queries were coordinated in advance, including drafting explanations for transactions if questioned.

One set of records refers to a KSh16 million deposit made into a KCB account held by an individual identified as Veronica Nyabuto shortly after the flagged transfer. Investigators are said to be examining the purpose and source of that deposit. No finding of bribery or illegality has been made by a court.

Other Transactions Under Review

The documents also reference other payments involving companies linked to individuals associated with the Deputy President, including transactions during the KEMSA procurement period, where suppliers received large sums for medical supplies.

In one instance, funds from a supplier account were allegedly transferred to an account associated with Khawaja. In another, CBK queries were reportedly responded to by senior KCB officials, with sign-off delegated to the bank’s finance office.

Separately, a later multi-billion-shilling KEMSA transaction involving a different supplier is cited in the materials. In that case, the documents allege that CBK queries were again answered through KCB channels. No charges have been announced in relation to these claims.

No Judicial Findings Yet

It is important to note that no court has made findings of guilt against any of the individuals mentioned in connection with these transactions. The matters described remain subject to regulatory review, investigation, or public allegation, depending on the instance.

KCB Group, Joshua Oigara, Adil Khawaja, and persons linked to the Deputy President were contacted for comment. No responses had been received by the time of publication. This article will be updated if responses are provided.

Why the Claims Matter

Financial-crime analysts say the issues raised highlight the central role banks play in detecting and reporting suspicious transactions, and the importance of clear separation between political influence, legal representation, and banking controls.

Whether the transactions amount to regulatory breaches or criminal conduct remains a matter for investigators and the courts.